If you are on the blog page in a web browser from a computer, please subscribe to this using the "Follow by Email" link to the left. Having your email helps me to notify you when Google mucks up email distribution, as they did at the beginning of May.

~~~~~~~

For the AAII CI-SIG group, we are planning to have a face-face meeting on 3/25. Details to follow.

~~~~~~~

There are 2 pending SELL orders going into the open.

There are 3 pending BUY orders going into the open.

1) Sell 10% position in IWM under the TPS 1-2-3-4 strategy.

- The order is STC 12 shares market at the open.

- I took this trade 15 seconds before the close last evening, and was filled at $139.94. We'll see if this morning's open does better or worse.

2) Sell 40% position in IWM under the 3d High/Low strategy.

- The order is STC 48 shares market at the open.

- Same comment as above; I took the trade at the close (because I could).

Remember, historically, there is a slight edge taking the trade at the close rather than the next morning's open, but it may simply be a statistical game with numbers. In the big picture it probably does not matter.

Also note that I took the trades together, e.g., the actual order I placed was STC 60 market at the close.

My buy side fill was at $138.43. This equates to a $1.51 gain per share or a profit, less commissions ($2 round trip) of $88.60. The amount invested was $8,305.80 so the 1-day gain on the amount invested was 1.07%.

Pending Buy Orders for Tuesday:

The following are the recommended buy orders for Tuesday:

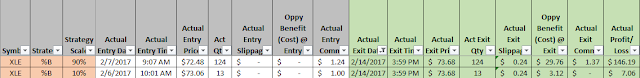

Click on the image to enlarge.

These were calculated on a base portfolio of $66,603.

- TPS allows for 4 positions total. This means that a fully-loaded TPS position would be $16,651.

- 10% of this is $1,665.

- EEM closed at a value of $38.36. $1665 / 38.36 = ~ 43 shares

- FXI closed at a value of $38.30. ~ 43 shares

- EWT closed at a value of $32.50. $1665 / 32.50 = ~ 51 shares

The orders are:

- BTO 43 EEM market at the open

- BTO 43 FXI market at the open

- BTO 51 EWT market at the open

Note that I will make these orders active at 9:32 a/ET, to allow the "book" to clear. EEM and FXI are very liquid ETFs with a bid/ask spread of only $0.01. EWT is less liquid, but still has a b/a of generally less than $0.02.

~~~~~~~

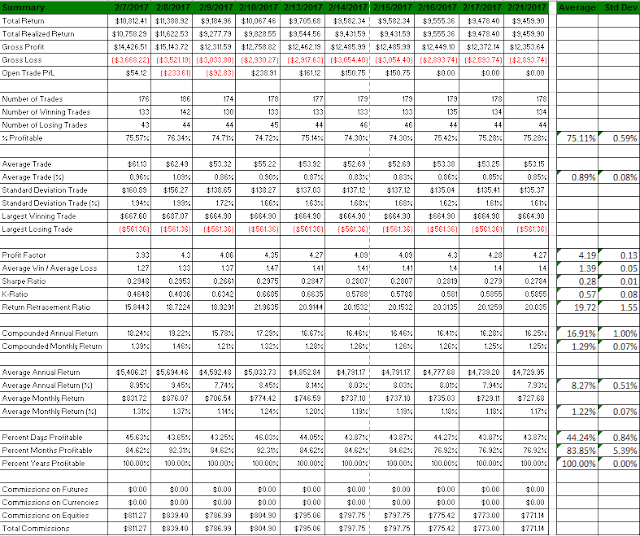

1-Year Rolling Performance

Historical, rolling, 1-year performance is as follows. The numbers will be different than previous blog entries because this is a ROLLING snapshot -- the period shown below is 3/1/2016 to 2/28/2017 (through Tuesday morning, to capture all end-of-day trades on the previous day). Note that these are the values that START the next trading day, e.g., 2/28/2017 for the set below:

| Summary | Value |

| Total Return | $7,849.94 |

| Total Realized Return | $7,752.94 |

| Gross Profit | $11,234.15 |

| Gross Loss | ($3,481.21) |

| Open Trade P/L | $97.00 |

| Number of Trades | 234 |

| Number of Winning Trades | 175 |

| Number of Losing Trades | 59 |

| % Profitable | 74.79% |

| Average Trade | $33.13 |

| Average Trade (%) | 0.69% |

| Standard Deviation Trade | $94.01 |

| Standard Deviation Trade (%) | 1.66% |

| Largest Winning Trade | $442.60 |

| Largest Losing Trade | ($469.06) |

| Profit Factor | 3.23 |

| Average Win / Average Loss | 1.09 |

| Sharpe Ratio | 0.2592 |

| K-Ratio | 0.4644 |

| Return Retracement Ratio | 17.361 |

| Compounded Annual Return | 13.75% |

| Compounded Monthly Return | 1.06% |

| Average Annual Return | $3,924.97 |

| Average Annual Return (%) | 6.68% |

| Average Monthly Return | $654.16 |

| Average Monthly Return (%) | 1.08% |

| Percent Days Profitable | 43.03% |

| Percent Months Profitable | 75.00% |

| Percent Years Profitable | 100.00% |

| Commissions on Futures | $0.00 |

| Commissions on Currencies | $0.00 |

| Commissions on Equities | $907.32 |

| Total Commissions | $907.32 |

Note that all 7 Connors' Long strategies are part of the results above.

Rolling snapshots are far more accurate of an indicator, especially when combined, because they provide a "what if I start right now" view of strategies. This is my intent with posting this on a day-by-day entry.

Go back through older blog entries to review the consistency of the 1-year rolling snapshots.

~~~~~~~~~

As with all my ramblings, you are responsible for your own investment decisions and I am not. Please do your own diligence, and please take ownership for your actions.

Regards,

pgd

~~~~~~~~~

As with all my ramblings, you are responsible for your own investment decisions and I am not. Please do your own diligence, and please take ownership for your actions.

Regards,

pgd