If you are on the blog page in a web browser from a computer, please subscribe to this using the "Follow by Email" link to the left. If you're on a mobile device you should see something in the frame that allows you to subscribe. Having your email helps me to notify you when Google mucks up email distribution.

~~~~~~~

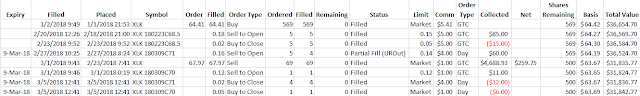

XLK

Back on January 2nd we bought 569 shares of XLK at $64.41. Our position in XLK, where we hold 500 shares, has an adjusted cost basis of $63.69, which has been moving downward due to three different sets of calls being sold and closed for profits. Further adding to this adjustment of basis on the remaining 500 shares is that I also sold the "surplus" of 69 shares, at a profit of $259.75, and have rolled that back into the cost basis, capturing $382.75 in total. We now have 5 lots of 100 shares, with no odd lot amounts. Once the math is done the new cost basis results. Here are the details:

Click on the image to enlarge.

In order to protect the gains, I went ahead and placed an order to buy the XLK 180420P69 put for $2.03 (limit), which for 5 contracts will end up costing me $1015 + $5 (commissions) = $1020. This is a slightly out of the money put, just above today's close of $68.37, and guarantees that we will keep the gains in the account at least for another 45 days, since OE is on 4/20.

The math racks out favorably:

The new cost basis is the old basis of $63.69 + $2.03 (cost of put) = $65.72, and with commissions on a per lot basis ($1/100 shares), will take it to $65.73. No matter what happens to XLK at OE we will have a minimum profit of $69 - $65.73 = $3.27. On OE the return on the entire chain of selling calls, buying the stock, etc. is $3.27/$65.73 = 5% and annualized for the 45 days until OE gives 5% * 365 / 45 = 40.4%.

If XLK moves up beyond $69 we participate dollar for dollar in change of the underlying. Below $69 we keep our 5% raw / 40.4% annualized return. Here's the profit and loss chart:

Click on the image to enlarge.

Depending upon where we sit the week of 4/20, we can sell this put and buy another or close both the put and the stock.

The order is

BTO 5 XLK 180420P69 2.03 limit GTC

Of course, this is what I'm doing and is not what you should be doing. Your personal situation may be completely different. I'm telling you this purely for educational purposes.

I still am seeking to buy an additional 200 shares of XLK through selling puts. This would take the position to 700 shares and would represent 46.5% overall in the account. XLK is a diversified ETF, so I have no qualms about having a large stake in the ETF.

Note that I would never own a single position of stock that was 46.5% of my account.

I note that the XLK 180309P67 has a midpoint of $0.19 and a likely fill of $0.18. With commissions, this would net $0.17. $0.17/$67.00 = 0.25% and since there are only 4 days between Tuesday and Friday, the AROO would be 0.25% * 365 / 4 = 23.2%. The basis on this leg would drop from $67 to $66.83.

The order is:

STO 2 XLK 180309P67 0.18 limit GTC

Of course, this is what I'm doing and is not what you should be doing. Your personal situation may be completely different. I'm telling you this purely for educational purposes.

~~~~~

That's all for now. If you have questions -- ask.

~~~~~~~~~

As with all my ramblings, you are responsible for your own actions and I am not. Nothing I've written here is advice to buy or sell any security, so don't do it unless you absolutely take ownership for your actions.

Regards,

Paul