If you are on the blog page in a web browser from a computer, please subscribe to this using the "Follow by Email" link to the left. If you're on a mobile device you should see something in the frame that allows you to subscribe. Having your email helps me to notify you when Google mucks up email distribution.

~~~~~~~

Summary

The week was a successful week overall. DNKN, IP, MDC, VZ, and WBS were exited at losses, but gains were captured in ABBV, AMTD, MC, and PNC, resulting in a starting profit of $532.66 at the beginning of the week and ending at a total profit level of $1024.28. I also sold calls against the XLK position, which were bought back Friday at $0.02 each, resulting in a net profit of $70.00. Total cumulative realized (captured) profit for the portfolio is $1,094.28, not including dividends. This also does not include paper profits.

The non-dividend transaction log for the week is as follows:

Click on the image to enlarge.

The account has $20,267.36 in cash, the highest cash level since inception at the start of 2018.

The portfolio holds the following positions:

BHP 82

*BK 56

BLK 7

CFG 18

CFR 23

CM 20

CWT(1) 11

DRI 28

*EMR 33

GRMN 16

*HLI(0) 18

KAR 45

LVS 37

MGA 19

MNR(HB) 83

PAYX 84

RCL 27

WRK 68

XLK 569

The positions with an " * " are earmarked for sale using my standard methodology (see below) due to recent downgrade in revenue growth, earnings per share (EPS) growth, or a combination of the two as the outcome of the latest earnings reports (ER).

Strategy / Plan for the Next Week

I'm traveling next week so my availability to work on this portfolio will be limited.

Selling:

The selling critiera mandates that I ratchet upward the sell stop on stocks on a nightly basis. This value is never adjusted downward once a decision to sell a stock occurs. The stock will either 1) continue upward, with nightly ratchets of the sell stop moving upwards accordingly, or 2) it will descend and hit the sell stop, triggering the exit. The ratchet is set to 0.99 * the day's low. That's it -- nothing special. This method ensures that we capture any upward movement of the stock even though our longer-termed view is to not be exposed to the equity. I have written a TradeStation indicator to make this very easy for me to manage.

Buying:

Rather than purchase positions outright, I'm going to sell slightly out of the money (OTM) puts on the positions that I want to hold for the portfolio. I'm going to target a delta of -0.3 or smaller, but this is not a hard-fast rule. The goal here is to collect premium to lower the cost basis, and eventually be assigned.

Mechanics:

Purchasing the ideal, optimized Greenfield Sharpe Ratio portfolio down to the share has worked fine and the dividend collection has worked as designed/anticipated, at least for the past 7 weeks, which included a 5% downdraft. This being said, I'm looking to simplify.

I note the following:

- Although I've abstracted it away from you, the optimization process pointed to owning over 37 positions (recommended for the open on 2/2). This is like owning a miniature mutual fund and is a considerable amount of work to manage. That is the opposite direction from where I want to go.

- The ideal number to own today, 2/23 close, is 25 stocks. 90% of the portfolio is contained in the top 15 stocks, with the last 10% in the last 10 stocks. Certainly more manageable, but also still a larger number than I would like. Some of those positions are quite small and have little impact on the overall portfolio.

With this information in tow, I've modified the process to restrict purchases to increments of 100-share lots only. The question is "how much does this change the overall projected performance of the portfolio?"

Let's take a look at the Efficient Frontier, which is what this entire process is based upon:

The purple dot is the "optimized" portfolio configuration, down to the individual share, and the yellow diamond that is slightly to the right is the new projected portfolio with 100-share increments. Stocks that are below this 100-share level are not funded in the new portfolio, but are tracked in the event that their weightings change as a function of time.

The impact in this approach is relatively negligible on a delta (difference) between the Optimal Portfolio and the 100-share increment portfolio. In the figure below the "Current Portfolio" is the 100-share increment portfolio:

As you can see, in an ideal world the volatility is lower (16.78%) with the "Optimal Portfolio", which is what I would expect (more stocks generally dampen movement if they are loosely correlated). For this reduction in volatility potential gain (12.72%) is lower than the 100-share increment portfolio (12.80%).

Because this is all driving with the rear-view mirror (make sure you know why), the difference between the two portfolios is insignificant.

Here's the proposed new portfolio configuration:

Contrast this configuration with holdings that I have right now in those underlyings:

XLK 569

KAR 45

CM 20

KAR 45

CM 20

TROW (New)

WRK 68

PAYX 84

GRMN 16

GNTX (New)

New positions need to be established (TROW and GNTX), and other positions need to be built out. I only have a bit over $20,000 cash, so I'm going to work on various combinations to deploy that capital with writing cash-secured puts.

There will not be a significant difference in migrating to this new portfolio -- the shortest line connecting the purple dot and the yellow diamond in the Efficient Frontier (not shown --imagine it being there) is the anticipated performance between the two portfolios, so I'm not expecting any major differences while I transition from the 25+ holdings to this smaller set of stocks.

The other odd-lot positions in the portfolio will be sold as dictated by the existing sell rules. Because I cannot write a call against them ( XLK is the only position that I hold with more than 100 shares), they will be sold using the traditional ratchet stop loss method that I described above.

Impact on Dividend Income:

A natural question that I had concerns the impact that moving to a smaller number of stocks would have on the overall generation of dividend income. Note that the amount invested is the same, but because dividend payments are different, the impact could be significant.

I created a backtest using the Optimized Sharpe Ratio portfolio (titled "Portfolio 1"), which contains all the stocks down to the individual share ownership, a second portfolio that is the 100-share increment Optimized SR portfolio ("Portfolio 2"), a third portfolio which is a traditional income portfolio comprised of VTSMX/13%, VGTSX/7%, VBMFX/64%, and PIGLX/16% ("Portfolio 3").

I ran the test from February 1, 2017 to January 31st, 2018. Here are the results:

The results show that Portfolio 1 slightly outperforms Portfolio 2 in terms of income; the actual dividends paid were $2,606 vs. $2,575 for Portfolio 2. Portfolio 3 (the income portfolio) generated $2,216, so nearly $400 less than Portfolio 1 and nearly $360 less than Portfolio 2.

From this I conclude that Portfolio 2 -- the 100-share increment portfolio, will pay dividends at nearly the same levels as the "all-in Portfolio 1" while reducing the number of stocks that I must manage.

I also decided to compare portfolio performance over the past 12 months; here are those results:

Portfolio 1 and Portfolio 2 are virtually on top of each other, with a slight edge to Portfolio 1. Commissions were not included so it is conceivable that the greater number of stocks would reduce the portfolio performance to that of Portfolio 2 (or lower).

I added a benchmark -- the Vanguard 500 Index -- and you can see that it lagged the performance of these stocks by a measurable amount.

Portfolio 3 -- the income portfolio -- did not lose value, but it did not gain much relative to the other Portfolios.

From this I conclude there is no significant difference between Portfolio 1 and Portfolio 2, so the 100-share increment portfolio should perform just fine, relative to the "all in Portfolio 1". This was also shown in the Efficient Frontier picture as well as the projected performance table.

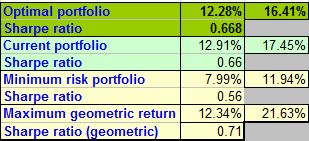

A table of the numbers from the portfolio analysis as follows and is provided without comment:

Click on the image to enlarge.

~~~~~~~~~

My next steps are to figure out which stocks I want to write cash secured puts against. I've done the preliminary analysis; here is the table:

Click on the figure to enlarge.

TROW and XLK offer weekly options; I've drawn a "W" at the top indicating those two as possibilities. I like weeklies since they do not tie up capital -- the trade off is that premiums are lower.

I've also marked the row "PURCHASE DISCOUNT IF EXERCISED (%)" -- this is the amount of reduction in break-even in that stock relative to if I were to purchase it at the open Monday morning. Selling (and collecting) premium lowers this value, which is the entire purpose of this effort.

As I stated, I do not have enough cash to sell all these options, so I have to pick and choose. I'll decide that over the weekend.

~~~~~~~~~

As with all my ramblings, you are responsible for your own actions and I am not. Nothing I've written here is advice to buy or sell any security, so don't do it unless you absolutely take ownership for your actions.

Also, if you have any questions, feel free to drop me a note.

Make it a great weekend!

Regards,

Paul