.If you are on the blog page in a web browser from a computer, please subscribe to this using the "Follow by Email" link to the left. Having your email helps me to notify you when Google mucks up email distribution, as they did in early March 2017.~~~~~~~

There are 2 sell orders for the open.

There are 10 buy orders for the open.

~~~~~~~

The two sell orders are in the EWT and FXI positions.

- STC 370 shares FXI market at 9:32 a.m.

- STC 303 shares EWT market at 9:32 a.m.

I took the trades at the close yesterday afternoon (3:59 pm ET) and received 38.91 and 33.61, respectively.

The buy orders, and the respective strategies in parenthesis, are as follows:

- BTO 68 shares EFA market at 9:32 a.m. (RSI 25)

- BTO 115 shares XHB market at 9:32 a.m. (RSI 25)

- BTO 136 shares EFA market at 9:32 a.m. (R3)

- BTO 230 shares XHB market at 9:32 a.m. (R3)

- BTO 21 shares EFA market at 9:32 a.m. (TPS)

- BTO 29 shares EFA market at 9:32 a.m. (RSI 10/6)

- BTO 46 shares XHB market at 9:32 a.m. (TPS)

- BTO 54 shares EFA market at 9:32 a.m. (MDD)

- BTO 56 shares XLV market at 9:32 a.m. (RSI 25)

- BTO 66 shares EWJ market at 9:32 a.m. (MDD)

Base portfolio size is $67,483, including the recent gains.

The TPS strategy allows 4 positions. A fully loaded position would be $16,870. The new positions in EFA and XHB are first time entries to this strategy and are at 10% scale-in, so each order is $1,687 in size.

The RSI 25 strategy allows 8 positions. This is a fully-loaded position size of $8,435. The scale-in is 50/50, so each order is $4,217 in size.

The R3 strategy also allows 8 positions with no 2nd entry (each position is 100%). Hence, the order size is $8,435.

The MDD strategy allows 12 positions. A fully loaded position would be $5,623 in size. The scale-in is 60/40, and these are 1st entries. hence the size is $3,374.

The RSI 10/6 strategy allows 13 positions. A fully loaded position would be $5,191. The scale-in is 35/65, making the first entry $1,816 in size.

Combining orders to take advantage of commissions, we have

- BTO 308 shares EFA market at 9;32 a.m.

- BTO 391 shares XHB market at 9:32 a.m.

- BTO 56 shares XLV market at 9:32 a.m.

- BTO 66 shares EWJ market at 9:32 a.m.

~~~~~~~

The only option on these four ETFs worth pursuing is with EFA. If I sell the April 62.5 call at $83 my total gain could be another 1.35% and monthly gain equating to 2.81%. I am placing the following order:

- STO 3 EFA 170421P62.5 0.83 limit GTC

~~~~~~~

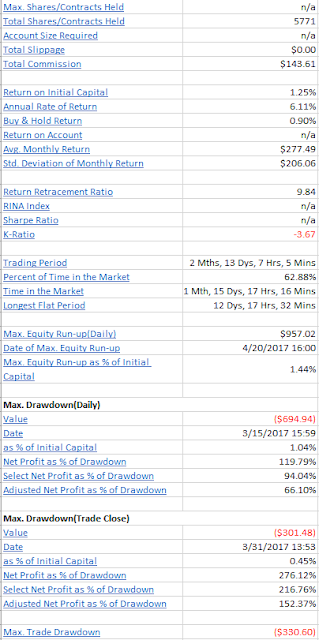

3-Month Rolling Performance

Historical, rolling, annualized 3-month performance from the 3-month backscan is as follows. The numbers will be different than previous blog entries because this is a ROLLING snapshot -- the period shown below is 1/7/2017 to 4/6/2017. Roughly multiply the values by 4 to get an annual value (dollars and trades only; the other percentage metrics are accurate for the time period and need no multiplication).

| Summary |

Value |

| Total Return |

$1,535.00 |

| Total Realized Return |

$1,260.05 |

| Gross Profit |

$2,448.17 |

| Gross Loss |

($1,188.12) |

| Open Trade P/L |

$274.95 |

| |

|

| Number of Trades |

67 |

| Number of Winning Trades |

46 |

| Number of Losing Trades |

21 |

| % Profitable |

68.66% |

| |

|

| Average Trade |

$18.81 |

| Average Trade (%) |

0.29% |

| Standard Deviation Trade |

$80.29 |

| Standard Deviation Trade (%) |

1.01% |

| Largest Winning Trade |

$211.72 |

| Largest Losing Trade |

($293.40) |

| |

|

| Profit Factor |

2.06 |

| Average Win / Average Loss |

0.94 |

| Sharpe Ratio |

0.1132 |

| K-Ratio |

0.1481 |

| Return Retracement Ratio |

6.4229 |

| |

|

| Compounded Annual Return |

6.68% |

| Compounded Monthly Return |

0.53% |

| |

|

| Average Annual Return |

$1,535.00 |

| Average Annual Return (%) |

1.54% |

| Average Monthly Return |

$383.75 |

| Average Monthly Return (%) |

0.38% |

| |

|

| Percent Days Profitable |

45.90% |

| Percent Months Profitable |

75.00% |

| Percent Years Profitable |

100.00% |

| |

|

| Commissions on Futures |

$0.00 |

| Commissions on Currencies |

$0.00 |

| Commissions on Equities |

$321.39 |

| Total Commissions |

$321.39 |

Note that no strategies are omitted from these results.

~~~~~~~~~

As with all my ramblings, you are responsible for your own investment decisions and I am not. Please do your own diligence, and please take ownership for your actions.

Regards,

pgd