If you are on the blog page in a web browser from a computer, please subscribe to this using the "Follow by Email" link to the left. If you're on a mobile device you should see something in the frame that allows you to subscribe. Having your email helps me to notify you when Google mucks up email distribution.

~~~~~~~~~~

Overview/Review

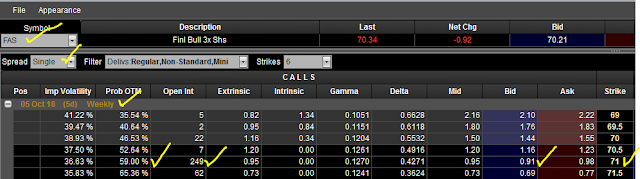

I'm attempting to reduce the number of assignments that occur as a result of the cash-secured-put (CSP) strategy that I'm using. Ideally, we want to sell premium in a stock or ETF and have the equity close at 4 pm ET on the day of option expiration (OE) above the strike value of the put. When this occurs, we collect the full premium of the option that we sold, less any commissions.

We have recently experienced a sharp drop in markets that started around the end of September/beginning of October. When we sell premium on options and when the value of the equity drops below the strike price of the option that I sold, it's considered in the money (ITM) and if it does not recover above the strike by OE, we will be assigned the stock at the strike price, not the market price. By design this means we will carry a paper loss in the portfolio until 1) the stock recovers OR 2) we can lower the stock basis by selling more premium and/or buying more shares at a cheaper price.

Personally, I do not like carrying a paper loss.

I mitigate part of the risk by buying quality stocks (rising earnings, revenues, and free cash flow), but this is not a guarantee that the stock will rise. It simply suggests that the stock will not go to zero, but certainly, it can drop.

I also place a buy-to-close (BTC) order on every CSP that I sell, and if I'm greater than 5 days from OE, I set the value to $0.10 and if I'm within a week of OE, I set the value to $0.05. This helps ensure that if the option price gets close to worthless sometime in the contract period I can close out and lose the obligation to buy the stock if it is ITM at OE.

What is better is to simply not be assigned the stock in the first place, e.g., ensure that the stock never drops below the strike value of the option.

Alerting Process

Every day potential CSP position-sell-alerts are generated by my system and are echoed in real time to my Twitter feed ( https://goo.gl/UoGgBg ) as well as to a shared Dropbox folder: https://goo.gl/WbuJhS The Dropbox folder contains an historical view of all alerts that met my CSP criteria.

I do not always take every trade that is alerted, but since these are broadcast, I presume that every alert is reviewed and possibly entered by one of my followers.

I've changed my stock-selection strategy over the past two weeks, since October 13th, so trades after this period should expire worthless or there should be an incredibly low percentage of trades that are assigned.

The November 2nd OE just closed yesterday, and the following shows unique options that were alerted since September:

Click on the image to enlarge.

The rightmost 5 columns: Underlying Close on 11/2, Assigned, Option Close Value, BTC Fired, Assigned, are all added as part of this analysis. It should be clear what each column represents -- if not, feel free to ask.

Results

As you can see, only 12 options fired alerts since 9/18. This is in part because I naturally omit stocks based upon price performance, and if they are dropping, they are in a downtrend, which is poor for a cash secured put. Hence, every one of these stocks was in an uptrend at the date/time that the alert was generated. For those that ended on OE ITM, they simply collapsed after the alert was generated. This is what I seek to avoid.

Of interest is that had I taken every signal, I would be holding every one of the top 4 stocks right now MOMO-HES-VRTX-CMI. These closed below the option alert value, and these never would have fired my BTC. These positions moved against me and had I sold them, I would be holding stocks at a considerable loss (on paper). You can see these designated as "1" in the rightmost column (they were assigned).

Stocks that alerted for the 11/2 OE since 10/15 have performed much better, despite some of the negative downward movements of the market. Out of this list, only one -- ADBE -- would have been assigned yesterday, and this is a good sign. All the rest would have expired worthless (close of the stock was above the option strike) or the value of the option got within the BTC value of $0.10 or $0.05, depending on the week considered.

You can look at the underlying performance in the following chart: this plots the S&P 500 (down about 1% since 10/15) and all the other stocks that alerted since that date. All are up relative to their alert dates:

Click on the image to enlarge.

Conclusions

Although this is only the 2nd week of alerts that I've evaluated, the new stock selection process looks like it could be helping to reduce the potential of being assigned. Out of the 12 alerts for 11/2, 8 were generated on or after 10/15, and only one of these would have been assigned.

I will keep track of this going forward and we'll see if there is an improvement in assignment rate (measured as number of stocks assigned vs. number of alerts).

Stay tuned.

~~~~~~~~~

That's all for now. If you have questions -- ask.

~~~~~~~~~

As with all my ramblings, you are responsible for your own actions and I am not. Nothing I've written here is advice to buy or sell any security, so don't do it unless you absolutely take ownership for your actions.

Regards,

Paul