If you are on the blog page in a web browser from a computer, please subscribe to this using the "Follow by Email" link to the left. If you're on a mobile device you should see something in the frame that allows you to subscribe. Having your email helps me to notify you when Google mucks up email distribution.

~~~~~~~~~~

Administratia:

Please read the previous blog entry regarding my Twitter CSP alerts. The link is here: https://fwdtest.blogspot.com/2018/09/csp-updates-for-friday-sep-28.html

~~~~~~~~~

Multi-timeframe uptrending stocks and ETFs have been updated for the open on Monday, October 1st, and are available here ( https://goo.gl/XZKgwY ). The archive subfolder contains historical lists that you can review back in time and see how they would have performed going forward.

The alerts files (monthly historical as well as the alerts generated today, after market open), are available here ( https://goo.gl/WbuJhS ). The archive subfolder contains historical alerts files that you can review.

Real-time Q&A with me, if I'm available, is through this link: https://discord.gg/4QAUqyd This is Dr. Jeff Scott's HGSI Discord forum and it's worth your time to join (free). I am @PaulDuncan at Discord and I typically watch the #cashsecuredputs-n-coveredcalls channel. Come say "hello"!

~~~~~~~~~~

Theoretical 9/28 Option Expiration Performance

Here is a review of the alerts for the 9/28 OE. The following options expired out of the money (OTM), so the premium collected is ours, less commissions:

9/13/2018 ADBE 180928P252.5

9/20/2018 ALGN 180928P360

9/18/2018 ALGN 180928P370

9/26/2018 ALGN 180928P375

9/24/2018 BBY 180928P76

9/24/2018 FFIV 180928P190

9/13/2018 FIVE 180928P125

9/14/2018 GRUB 180928P136

9/24/2018 HES 180928P70

9/21/2018 LNG 180928P65

9/17/2018 NOW 180928P190

9/7/2018 PTCT 180928P41

9/6/2018 SQ 180928P80

9/12/2018 SQ 180928P85

9/17/2018 SQ 180928P87

9/25/2018 TQQQ 180928P66

9/24/2018 UCO 180928P33

9/24/2018 ULTA 180928P267.5

9/24/2018 UPRO 180928P55

9/24/2018 UPRO 180928P55.5

9/24/2018 XLNX 180928P75

9/25/2018 XLNX 180928P76

Over the life of the option contract the following alerts never hit our $0.10 or $0.05 buy-to-close (BTC), and since they were in-the-money (ITM) at the close, will be assigned. We still get to keep the premium, which goes into the general fund, and now we must sell a covered call against each of these come Monday:

FAS 180928P71

FAS 180928P73

JDST 180928P80

KMX 180928P76

LITE 180928P60

MOMO 180928P45.5

I note that LITE closed at $59.95, just $0.05 ITM. *assigned!*

So, 6 of 28 were assigned, or about 21%. I'm working on improving this number - the research is ongoing but is resulting in better identification of turning points and a better time to enter the write-put or write-call order. The goal is no assignments and 100% expire worthless or hit their BTC before OE, but obviously, this is a moving target because the markets are constantly changing.

NONE of the assigned positions are lower than 7% paper loss, and the average paper loss is -2.6%. This means that on Monday most will have a call with very high premium close to our closing strike price.

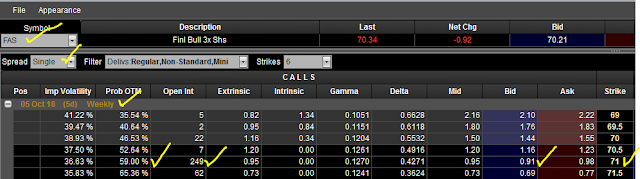

So, for example, for the assigned FAS 180928P71, I'd sell the $71 call ("breakeven strike") for 10/5 for about $0.90, which is 0.90/71 = 1.29% Return on Option (ROO) and for the 5 days next week, is 1.29 * 365 / 5 = 95% annualized return (AROO). If it gets called we keep all of the premium and lose possession of FAS, and if it doesn't get called we still keep the premium and get to sell another call the following week. The graphic below shows the call side of the option chain for FAS for 10/5, at the $71 breakeven strike:

Click on the image to enlarge.

So, for example, for the assigned FAS 180928P71, I'd sell the $71 call ("breakeven strike") for 10/5 for about $0.90, which is 0.90/71 = 1.29% Return on Option (ROO) and for the 5 days next week, is 1.29 * 365 / 5 = 95% annualized return (AROO). If it gets called we keep all of the premium and lose possession of FAS, and if it doesn't get called we still keep the premium and get to sell another call the following week. The graphic below shows the call side of the option chain for FAS for 10/5, at the $71 breakeven strike:

Click on the image to enlarge.

I note that the actual premium received will be determined after the market opens on 10/1. The figure above is snapped during non-market hours, so is subject to change.

Rinse, repeat.

Rinse, repeat.

I personally like to sell a call right at the assignment price ("breakeven strike") because holding stock is far more risky than holding a cash-secured put, and I want the equity to be called away as soon as possible.

One final thought: On the assigned positions, I'm most likely going to BUY a PUT at the same time that I SELL a CALL. I was just assigned a position in JDST, so let me demonstrate the thinking.

1) Find the minimum premium that I'm willing to receive for a COMBO transaction.

~~~~~~~~~~

Theoretical 9/28 Option Expiration Performance

One final thought: On the assigned positions, I'm most likely going to BUY a PUT at the same time that I SELL a CALL. I was just assigned a position in JDST, so let me demonstrate the thinking.

1) Find the minimum premium that I'm willing to receive for a COMBO transaction.

- My breakeven strike is $79.00 I want this money to work for me, so I'll sell a call at this strike.

- My target AROO is 20%. Your actual mileage may be different. Be realistic, and as I've proven, 20% is well within the reach of my strategy.

- My strategy currently has a win/loss rate of 92% (and change). I adjust the minimum premium by this so we "juice" the premium requirement by this amount to drive it upwards. Ask if this isn't clear.

- There will be 2 contracts, one on the call side, and one on the put side.

- I've set a buy-to-close (BTC) of $0.05 on the call -- it is possible that if the ETF rockets downward towards my put that this could trigger. I can turn around and sell another call if this happens (Alan Ellman's "hit a double").

- Round trip commissions is actually just the entry commissions for both the call and the put ($1 each at TradeStation) and the called away commission ($14.95). My expectation is to be called away and for the put to expire worthless.

- 5 days to expiration (Mon-Fri)

- Collect a minimum of $67 to hit at least a 20% AROO.

2) Now, go find a combo that results in meeting at least $0.67 in received premium:

When we look at the profit/loss graph, we have the following:

Click on the image to enlarge,

There's a lot of information here:

- I can achieve approximately $0.78 collected in premium by selling the JDST 181005C79 and buying the JDST 181116P59. This is above my minimum premium requirement of $0.67.

- The combo lowers my exposure more than just selling the call. The net delta (using weekend numbers and presented without proof here) is 100 (long 100 shares JDST) + (-50.2359) (short 1 JDST 181005C79) = ~49.8 and when I add the JDST 181116P59 long put (delta -14.0937) I end up with the circled -64.3296 delta adjustment, making my next exposure $35.67/contract. This is why I keep saying that options are better than owning stock -- your exposure is less than owning the stock outright.

- There are few nuances in the graphic. The darker area is the 1-standard deviation move of JDST between now and November 16, which is the expiration of the put. There is a 68% chance that JDST could fall to our put within this time.

- If that occurs (price falling to around $59, we'll lose money at the -$35.67/-$1 change in underlying, but the value of the put will go up at least $14/-$1. Once the price falls enough, the put delta increase will exceed the rate at which the call is reducing, so while we will still be underwater, we'll have downside protection.

- While it doesn't show it in the graphic due to time value, below $59 we are completely covered in risk.

So, what is the risk profile for this strategy? Glad you asked.

- Holding just 100 shares of JDST at a break even of $79 means we lose $1 for every dollar drop (-$1 / -$1) in JDST. Conversely, we make $1 / $1 for every dollar rise in JDST. The position delta is "100" for every 100 shares that we own. Get used to this concept of delta. It's really important when you own a zillion positions and want to know your portfolio exposure.

- If JDST closes above $79 on 10/5, the equity will be called away at $79, not including commissions. This is the best possible case, and is the goal for any covered-call position in terms of risk reduction.

- If JDST closes below $79 on 10/5 but above ($79 - 0.78) = $78.22 then we make *some* money, just not our full 20% that was a our target. The position delta (including the protective put), is somewhere between ~64 and ~86, depending upon how close to $79 we are or how close to $78.22 we are. This is okay, because if you owned 100 shares and had zero options you would lose between $0 and $78. Make sure you understand why, and ask if you don't understand.

- If JDST closes below $78.22 the call expires worthless and the put is increasing in value. Position delta is at least 86 but is dropping (which is good) as the put value increases. On paper you are losing no more than $86/$1 change in JDST and this rate improves (gets less) as the price drops. We have until November 16 to keep playing with our 100 shares in JDST and have downside protection. Remember, you pocketed $78 in selling the put/call combo, and since the put is still alive, now it's time to sell another call for 10/12. Keep collecting premium, and enjoy the downside put protection.

You get the idea.

~~~~~~~~~~

Theoretical 9/28 Option Expiration Performance

The strategy continues to plod forward. On a month-over-month basis, the good/bad/ugly for the entire option portfolio has the following equity chart:

Click on the image to enlarge.

So, 9-months in with real money, full visibility of what I'm doing, etc. shows that on a month-over-month basis it is possible to generate consistent income by selling cash secured puts and covered calls. Note, a strategy adjustment was made at the end of January 2018 to account for the mistakes made in January 2018, and these changes (position size rules and rejection of emotion) have helped portfolio performance in a dramatic way.

Breaking this down by week shows a few more bumps that are not visible in the monthly:

Click on the image to enlarge.

The last week of August and the second week of September were slightly negative due to the lack of positions to take that met minimum premium as well as a few rolled positions that resulted in losses within those weeks (when you roll, you buy-to-close an existing position, and if you have to pay to BTC, you may have to give up your premium if the buy price was more than you sold the original position).

In general, I'm quite pleased with the lower-left / upper-right trajectory. I can take a few weekly bumps, and am constantly learning how to improve.

Note: The addition of the "buying a put" well OTM that I discussed previously with JDST is another enhancement and should also reduce risk and improve long-term performance, at minimal impact to overall profits.

~~~~

That's all for now. If you have questions -- ask.

~~~~~~~~~

As with all my ramblings, you are responsible for your own actions and I am not. Nothing I've written here is advice to buy or sell any security, so don't do it unless you absolutely take ownership for your actions.

Regards,

Paul

Click on the image to enlarge.

So, 9-months in with real money, full visibility of what I'm doing, etc. shows that on a month-over-month basis it is possible to generate consistent income by selling cash secured puts and covered calls. Note, a strategy adjustment was made at the end of January 2018 to account for the mistakes made in January 2018, and these changes (position size rules and rejection of emotion) have helped portfolio performance in a dramatic way.

Breaking this down by week shows a few more bumps that are not visible in the monthly:

Click on the image to enlarge.

The last week of August and the second week of September were slightly negative due to the lack of positions to take that met minimum premium as well as a few rolled positions that resulted in losses within those weeks (when you roll, you buy-to-close an existing position, and if you have to pay to BTC, you may have to give up your premium if the buy price was more than you sold the original position).

In general, I'm quite pleased with the lower-left / upper-right trajectory. I can take a few weekly bumps, and am constantly learning how to improve.

Note: The addition of the "buying a put" well OTM that I discussed previously with JDST is another enhancement and should also reduce risk and improve long-term performance, at minimal impact to overall profits.

~~~~

That's all for now. If you have questions -- ask.

~~~~~~~~~

As with all my ramblings, you are responsible for your own actions and I am not. Nothing I've written here is advice to buy or sell any security, so don't do it unless you absolutely take ownership for your actions.

Regards,

Paul

Thanks Paul,

ReplyDeleteThat long dated put looks like simple brilliance.I so wish I had done that.lwill next time!

Graeme

Agreed Graeme. We are both in the same canoe with respect to AMAT. This approach, where I use some of the call premium to buy a put that is within 1 standard deviation will work for more volatile stocks. I'm having trouble finding liquid OI for puts that are far OTM yet are within one standard deviation of move by OE. Stay tuned.

Delete