If you are on the blog page in a web browser from a computer, please subscribe to this using the "Follow by Email" link to the left. If you're on a mobile device you should see something in the frame that allows you to subscribe. Having your email helps me to notify you when Google mucks up email distribution.

~~~~~~~

Past Transactions Since Last Report

The following transactions occured this week:

Click on the image to enlarge.

I notified the group that I was selling MDC -- the order persists, and I keep raising the sell stop loss level. The level going into 2/12 is currently $28.13 and keeps getting adjusted upward if the price moves upward. The level is a ratchet set to 0.99 of the day's low and is never lowered. MDC is slowing in terms of revenues and EPS, which has triggered it for sale.

As I mentioned last week, MDC will pay $0.30/share on 2/21 for holders on 2/7. That's us!

~~~~~~~

Newly-Identified Positions to Sell

MC, which is Moelis & Co., reported this past week and is also slowing in terms of revenues and EPS. It too is now slated for sale, with a stop loss set at $50.59.

MC is not slated to pay any dividend any time soon, so there are no considerations there. It was expected in January (based on a January 2017 schedule) but I've not been able to find any information on a real payment.

~~~~~~~

Newly-Identified Positions to Buy

The account has about $4,300 of cash that I am looking to deploy. The recent downdraft has significantly impacted the number of available stocks to review; the rise of the 1-month treasury bill also makes the risk-free-rate more compelling relative to some alternatives (link here). Volatility in all stocks has also jumped dramatically, causing the Sharpe Ratio of each stock (relative to historical performance) to drop a large amount.

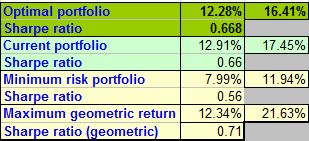

This being stated, here is what I am finding as the optimum portfolio going into 2/11:

The "new" positions, relative to current holdings, are MEOH and PNC. PNC is suggesting 30 shares at an entry of $153.15 or higher, and relative to MEOH, which is 6 shares at $56.03, completely dominates the conversation.

I've placed a buy stop loss for 30 shares of PNC at or above $153.15 for Monday and will adjust downward if the price drops and never hits the stop loss entry point.

PNC paid a dividend of $0.75/sh on 2/5 for record holders on 1/17; we were not owners so we will not receive this payment. I expect the next payment will be declared in April and received early May if history is any indicator.

~~~~~

Performance

The current and projected stats of performance, relative to current holdings as well as optimal configuration, are as follows:

Compared to January, the expected performance of the portfolio (Optimized or Current) are significantly lower and the volatilities have moved upward, as we have recently experienced.

All of these stocks pay a steady to increasing dividend, and at the current allocations shown above, I should receive $2,827 in dividend payments on the original $100,000 invested if I hold each of the positions at least through 4 dividend payments. This is 2.83% on a current risk-free rate of 1.32%. I have received $47.88 in January, and am expecting the following dividend payments, totaling $124.30, in the month of February:

ABBV will pay $0.71/sh, 43 shares, $30.53 total on 2/15

BHP will pay $0.22/sh, 82 shares, $18.04 total on 2/15

PAYX will pay $0.50/sh, 84 shares, $41.00 total on 2/15

AMTD will pay $0.21/sh, 23 shares, $4.83 total on 2/20

CWT will pay $0.188/sh, 11 shares, $2.06 total on 2/23

MDC will pay $0.30/sh, 33 shares, $9.90 total on 2/21

WBS will pay $0.26/sh, 69 shares, $17.94 total on 2/27 if we are holding on 2/13

We ended the week down; the current portfolio value is $98,196.46. We have captured $604.58 in trades and $47.88 in dividends and have a net loss of $1,803.54 (-1.8%). As a comparison, the SPY has dropped exactly -2.00% since 1/2/18 and the Russell 2000 has dropped -3.73% (link here).

~~~~~~~~

Summary

Onward and upward. The portfolio is performing fine, and the amount of work to manage it is not burdensome. It takes more to write these blog entries than it does to manage the portfolio, by far.

~~~~~~~~

As with all my ramblings, you are responsible for your own investment decisions and I am not. Please do your own diligence, and please take ownership for your actions. Nothing in this blog entry is to be construed as advise to purchase any security -- you follow what I do completely at your own risk.

Regards,

pgd

No comments:

Post a Comment