.

If you are on the blog page in a web browser from a computer, please subscribe to this using the "Follow by Email" link to the left. If you're on a mobile device you should see something in the frame that allows you to subscribe. Having your email helps me to notify you when Google mucks up email distribution.

~~~~~~~

It is likely that I am nearing the end of the purchase sequence. A number of entries filled on Thursday:

This series of purchases has taken me to about 89% invested; it is quite possible that if everything fills today we will see my test portfolio fully invested near 99.5%. Here are new orders that should help complete me today:

The astute among you will notice that this doesn't total ~$10K. As the process of buying and optimizing has occurred, the mixture has increased present holdings a small amount from the initial purchases. Hence, I'm adding to some positions to complete the portfolio:

If all of these fill near the prices indicated they will (between the two lots) add $10.3K to the portfolio and will take me to a bit under $100K.

The majority of the work is now done, and it's a matter of management of the positions.

The target portfolio, with allocations, is as follows:

The "yellow" is what I presently hold and "green" is what will be purchased today, not counting the slight adjustments to the existing positions.

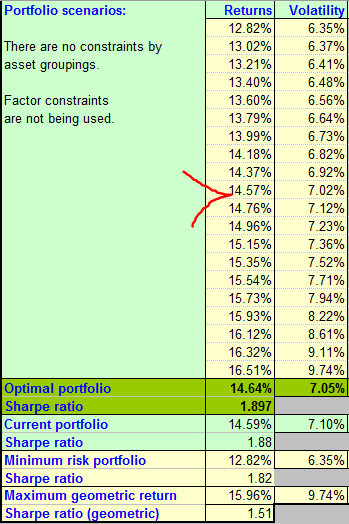

The target efficient frontier is as follows:

You can see that the present holdings (yellow diamond) and the optimum target portfolio are close -- very close. We're almost there.

The numbers on the portfolio, if the past is any indication of future performance (no guarantees there), are:

The target SR is 1.897 and I'm sitting at 1.88, and you can see that today's additions will only move me a few hundredths of a percentage point in annualized gain -- it's really in the noise. All I'm doing is maximizing the amount of capital deployed -- in the end the majority of the work with portfolio composition has been completed. 14% return on $90K is different than 14% return on $100K....

My next entry will most likely be after JPM reports, which is my first earnings report associated with my holdings. This is the only thing that could trigger a rebalance or sell of the JPM position, as the purchase criteria could potentially be violated, triggering an evaluation.

JPM reports before the open on Friday, January 12th.

Income for the portfolio, as I expect the numbers of 2017 to apply here in 2018, are as follows:

Portfolio 1 is the Greenfield Optimized SR portfolio, fully invested to the levels indicated, and Portfolio 2 is the same portfolio as shown yesterday.

~~~~~~~~~

As with all my ramblings, you are responsible for your own investment decisions and I am not. Please do your own diligence, and please take ownership for your actions.

Regards,

pgd

No comments:

Post a Comment